According to the South China Morning Post, China has spared no effort to produce chips under the situation of serious global shortage. According to the data released by the central government on Thursday, China's integrated circuit (IC) production hit a new high in June. According to the data of the National Bureau of statistics, in June this year, China's integrated circuit output reached 30.8 billion pieces, a year-on-year increase of 43.9%, exceeding the record of 29.9 billion pieces in May. This figure marks the first time that China has produced an average of 1 billion semiconductor units per day in a month

According to the data of the National Bureau of statistics, in the first half of the year, the total production of integrated circuits in China was 171.2 billion, a year-on-year increase of 48.1%

Despite the record output, the chips produced in China alone are still not enough to meet the local semiconductor demand. According to the data released by the General Administration of Customs on Tuesday, China imported more than 310 billion semiconductor devices in the first six months of this year, an increase of 29% over the same period in 2020. In June alone, China imported 51.9 billion semiconductors, almost twice China's domestic production

China also continues to fight the global chip shortage because it disrupts the semiconductor dependent market. In the case of a shortage of chips specially designed for automobiles, China's automobile production fell 13.1% year-on-year in June to slightly higher than 2 million vehicles, the same as the same period last year. However, automobile manufacturers continue to invest resources in electric vehicles. The production of new energy vehicles (NEVs) surged 135.3% to 273000 last month

The latest data show how the world's second-largest economy continues to go all out to pursue semiconductor self-sufficiency, which has become a long-lasting goal in Beijing's scientific and technological war with the United States. However, as China continues to rely heavily on imports to meet domestic demand, it is still vulnerable to sanctions against chips produced using American technology

Nevertheless, China's chip manufacturers continued to go all out to maintain record production, 29.1 billion and 28.7 billion in March and April, respectively

Although Chinese chip manufacturers cannot mass produce advanced 14 nm or smaller node chips (for powerful gadgets such as the latest iPhone), they can use more mature IC technology to produce chips for household appliances and cars

A report earlier this month showed that in the first five months of this year, China's newly registered chip related enterprises reached 15700, more than three times that of the same period in 2020

Behind the surge in new chip companies and production is a wave of investment in the industry, thanks in part to domestic subsidies and other incentives

How many chips has China produced

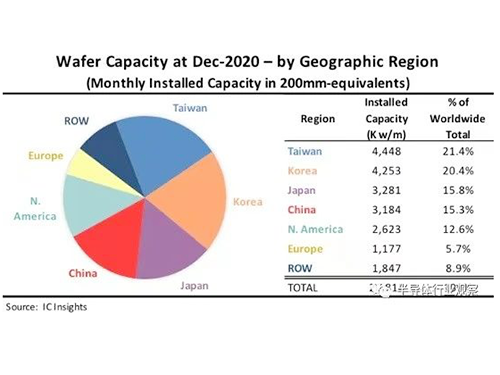

Recently, IC insights' global wafer capacity report 2021-2025 lists the global installed wafer capacity per month by geographical region (or country / region). Figure 1 shows the installed capacity by Region as of December 2020

Special emphasis should be placed on the meaning of data representation. The number of each region is the total monthly installed capacity of the factory located in that region, regardless of where the headquarters of the company owning the factory is located. For example, the wafer capacity installed by Samsung in the United States is included in the total capacity of North America, not in the total capacity of South Korea. The row "area" mainly includes Singapore, Israel and Malaysia, but also includes countries / regions such as Russia, Belarus and Australia

As of December 2020, Taiwan, China, has the world's leading installed wafer production capacity, with a market share of 21.4%. In second place is South Korea, accounting for 20.4% of global wafer production capacity. Taiwan, China is the leader in the production capacity of 200mm wafers. In terms of 300mm wafers, South Korea is in the forefront, followed by China and Taiwan. Samsung and SK Hynix continue to actively expand their factories in Korea to support their high-volume DRAM and NAND flash memory business. After surpassing Japan in 2011, Taiwan overtook South Korea as the largest capacity holder in 2015. It is estimated that Taiwan will still be the region with the largest wafer production capacity by 2025. It is expected that the monthly capacity of wafer factories in the region will increase by 1.4 million pieces (eight inch equivalent) between 2020 and 2025 By the end of

2020, Chinese mainland accounted for 15.3% of global capacity, almost equal to Japan's. It is estimated that the installed capacity of Chinese mainland will surpass Japan in 2021. China's share of wafer capacity exceeded that of Europe for the first time in 2010, row for the first time in 2016, and North America for the first time in 2019

expects that Chinese mainland will be the only area (3.7 percentage points) of the percentage increase in capacity share between 2020 and 2025. Although the launch of China's leading new DRAM and NAND Fabs is expected to weaken, in the next few years, there will be a large number of wafer capacity entering Chinese mainland based memory manufacturers and local IC manufacturers. p>

During the forecast period, the capacity share of North America is expected to decline, as the large fabless supplier industry in the region continues to rely on foundries, mainly in Taiwan. Europe's share of production capacity is also expected to continue to shrink slowly