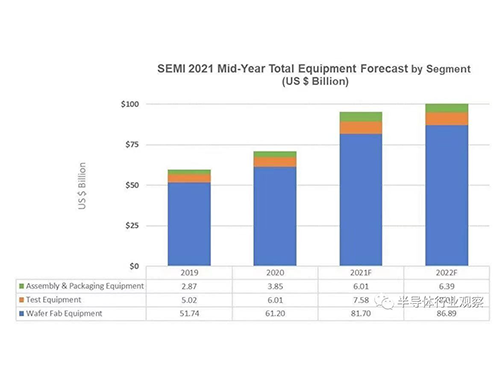

According to the latest semi report, the semiconductor manufacturing equipment of global original equipment manufacturers will reach a new high next year, which is expected to exceed US 0 billion. This is a new breakthrough compared with a year-on-year increase of 34% to US .3 billion in 2021 and US .1 billion in 2020

The fab equipment sector, including wafer processing, Fab facilities and mask / mask equipment, is expected to soar 34% to a new industry record of US .7 billion by 2021 and 6% to more than US billion by 2022

Due to the strong demand of global industrial digitization for cutting-edge technologies, OEM and logic departments account for more than half of the total sales of wafer plant equipment, with a year-on-year increase of 39%, reaching US .7 billion by 2021. It is expected that the growth momentum will continue in 2022, and the investment in OEM and logic equipment will increase by another 8%

Strong demand for memory and storage is driving spending on NAND and DRAM manufacturing equipment. DRAM equipment is expected to lead the expansion in 2021, soaring 46% to more than billion. It is estimated that the NAND flash memory device market will grow by 13% to US .4 billion in 2021 and 9% to US .9 billion in 2022

Driven by advanced packaging applications, the assembly and packaging equipment division is expected to grow 56% to billion by 2021, and then 6% by 2022. The semiconductor test equipment market is expected to grow by 26% to US .6 billion in 2021 and another 6% in 2022 based on the demand for 5g and high performance computing (HPC) applications

, from the regional perspective, South Korea, China Taiwan Chinese mainland and China are expected to remain the top three destinations for equipment expenditure in 2021, with South Korea's top memory in terms of strong memory recovery and strong investment in frontier logic and OEM. Equipment expenditure is expected to increase in all regions tracked in 2021

Semiconductor equipment power subsystem brings extraordinary revenue growth

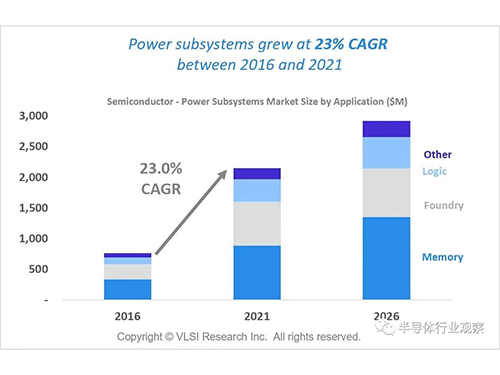

Due to a variety of positive factors, the sales of power supply and reaction gas subsystems for semiconductor manufacturing equipment are expected to achieve a compound annual growth rate (CAGR) of 23% between 2016 and 2021 - far exceeding the average level of 16.4% in the key subsystem industry

Process power and reaction gas subsystems accounted for about 13% of the expenditure on key subsystems of semiconductor manufacturing equipment, up from 9.8% in 2016. The drivers of this abnormal growth are:

Improving the vacuum strength of semiconductor manufacturing

The average number of RF power subsystems used per chamber increased

The trend of higher power subsystems, which will attract higher prices

Use a higher frequency power subsystem, which is usually more expensive

The emergence of multiple patterning and 3D NAND in mass manufacturing significantly increases the number of deposition and etching process steps

For 3D NAND, longer and more difficult etching processes require more comprehensive power solutions

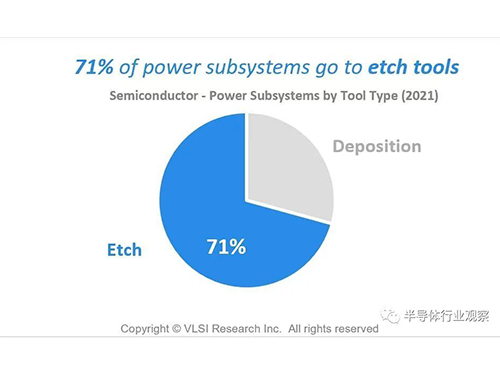

Interestingly, the analysis of power subsystem by tool type shows that the vast majority of power subsystems (70%) are used for etching tools and only 30% are used for deposition tools. This difference can be explained by the fact that a finer etching process may require multiple RF power solutions per tool. In contrast, plasma energy is not always used for deposition, for example, in thermal deposition processes

Despite the impressive growth performance of the power subsystem sector over the past five years, we expect the growth rate to slow significantly by 2026. Now that the transition from 2D NAND to 3D NAND has been completed, we expect the vacuum / plasma processing steps to be consistent with other equipment markets. In addition, the introduction of EUV is reducing the demand for vacuum treatment equipment

However, in the long run, a variety of patterning techniques in combination with EUV are still needed to achieve the expected improvements in device density and performance. It is estimated that by 2026, the future growth trend of power and reactive gas subsystem will be slightly higher than the average level of key subsystem industry (3.9%), with a CAGR of about 6.3%